Frequently Asked Questions

If you can’t find your answer here, reach out to

support@wayfinderETFs.com

General

Wayfinder is a collection of simple and accessible ETF products geared for every level of investor.

Please sign-up for our email updates to learn more.

Investment Strategy | CMBO

Wayfinder’s CMBO seeks to offer convenience plus potential premium for short-term, low-risk investments:

- Convenience: By utilizing CMBO, your position automatically rolls to into the next position. No need set reminders for yourself purchase T-bills.

- Short-Term Investment Plus Potential Premium: Keep cash liquid for a short period while generating a return plus a potential premium with minimal risk. Unlike investing directly in the T-Bill market, CMBO utilizes options to harvest the extra potential premium embedded in the market.

- Tax-Advantaged: CMBO is a tax advantaged product due because it is an exchange-traded fund (ETF). Generally speaking, ETFs are tax efficient which potentially makes them an attractive choice for those using taxable accounts. Be sure to read the prospectus and consult your own tax, legal, and accounting advisor before engaging in any transaction.

We believe box option positions are an underutilized area of the derivatives market that function like T-Bills but with a consistent yield premium. They are cleared and guaranteed by the OCC, highly liquid, and represent a way to potentially enhance cash returns.

- May act as a cash-management alternative.

- Can provide information on implied interest rates and the interplay between options, financing, and short-term rates.

As with all strategies, risks exist, but Wayfinder’s CMBO seeks to provide a compelling way to diversify short-term funding and enhance portfolio efficiency.

Similar to a T-Bill with face value of $1000 which can be purchased at a discount (which reflects the interest rate), a box option position with face value of $1000 will trade at a discount reflecting its embedded interest rate. The box’s implied interest rate is comprised of the equivalent T-bill rate plus a spread.

When trading a box option strategy, the buyer pays the discount price and receives the face value at expiration

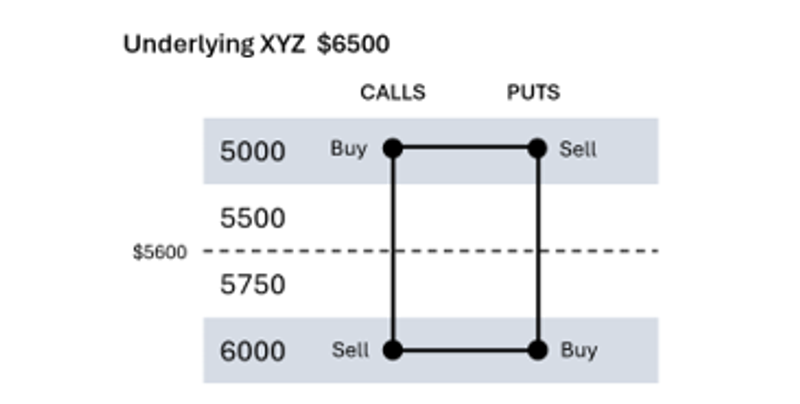

A box option position is created by combining four listed index options across two strike prices with the same maturity:

- Long call + Short put = Synthetic long exposure

- Short call + Long put = Synthetic short exposure

The strikes are set apart (commonly 1000 index points), locking in a known payoff at expiration equal to the difference between the strike prices.

KEY POINT

The box option strategy construction eliminates exposure to the underlying index level and dividends. The only economic driver is the difference between today’s purchase price and the fixed maturity payout.

The diagram below visually depicts the four components of box strategy on a vertical options price screen. The resulting shape is the reason the strategy became referred to as the “box.”

The box market functions as a short-term lending market for Options Clearing Corporation (OCC) participants and is guaranteed by the OCC, the largest derivatives clearinghouse globally. Like repo or securities lending, it is heavily used by institutional investors but remains underutilized by institutional allocators and overlooked by retail investors.

Box market pricing can be broken down into two components:

- the level of short-term interest rates and

- the spread over short-term interest rates (also referred to as the “excess yield”).

Short-term interest rates are influenced by central bank policies, economic indicators, and supply and demand dynamics.

As of October 1, 2025, it is estimated at approximately $75B+.

Maturities can vary from 1 month up to 12 months

The S&P 500 Index option market is amongst the most liquid markets in the world. Box positions can be liquidated before maturity with a typical aggregated bid/offer spread of approximately 10 bps.

Institutional mandates for “cash equivalents” often restrict investments to government securities, commercial paper, or repos. Boxes, despite being functionally equivalent, fall outside these guidelines. This segmentation creates persistent spreads relative to US T-Bills.

Historically, the excess spread over US T-Bills has been consistently positive; however, the amount can vary.

- 1M, 3M, and 12M boxes have shown spreads ranging from 0.30% - 0.75% above T-Bills

- Yields track closely to OIS (overnight indexed swap), LIBOR (London Interbank Offered Rate), and commercial paper, but boxes often sit at the upper end of the yield curve.

Notes:

LIBOR is a benchmark interest rate at which major global banks lend to one another in the short-term interbank market.

OIS rates reflect the market’s expectations of the central bank’s policy rate, and thus, they are considered a good gauge of short-term interest rate expectations.

In any market environment, an important benefit to the ETF structure is tax efficiency which potentially makes them an attractive choice for those using taxable accounts. Be sure to read the prospectus and consult your own tax, legal, and accounting advisor before engaging in any transaction.